CCH® SureTax® for SuiteTax NetSuite User Guide

Updated: July 11, 2024

Installing and Configuring CCH SureTax

Accessing the CCH SureTax Bundle

In order to access the CCH SureTax bundle, contact CCH Support and provide your NetSuite account ID. A CCH representative will submit a request to make the bundle available for installation.

As a precaution, a company needs to determine the level of access for their users. By default, the CCH SureTax-Configuration record type only allows Administrators to access the data. A company needs to grant appropriate permissions to any user role that modifies customer records or creates or edits trans- actions. If a user does not have appropriate permissions, they will receive an error message.

Enable Plug-in

- Select Customization > Plug-ins > Manage Plug-in Implementation.

- Select CCH SureTax Tax Engine Implementation.

- Select the check box to Enable.

Installing the CCH SureTax for SuiteTax Bundles

To install the CCH SureTax for SuiteTax bundles, do the following:

- Log in as an administrator, and then go to Customization > SuiteBundler > Search & Install Bundles.

- In the Keywords text box, enter CCH SureTax for SuiteTax

and press the Enter key. - Click the link for the result.

- Click Install.

- Verify that all the fields in the Custom Fields section have the Preference set to Show on Existing Custom Forms. This way all of the plug-in's custom fields will be shown on the existing custom transaction forms without manual modification.

- Click Install Bundle.

- Wait until there is a green check mark in the Status column.

- Repeat for the other module if necessary.

Updating the CCH SureTax for SuiteTax Bundles

When an update is made available to the plug-in, you will need to update the bundle to get the latest changes.

To update a bundle, do the following:

- Go to Customization > SuiteBundler > Search & Install Bundles > List.

- Locate the CCH SureTax for SuiteTax bundle you want to update.

- Hover over the Action column and click Update. This will take you to the Preview Bundle Update screen.

- Click Update Bundle.

- Wait for the Status column of the bundle to display a green check mark, showing that the bundle has been updated successfully.

The following permissions will need to be set on all roles that will be creating transactions:

Custom Records

| Record Name | Permission Level |

|---|---|

| CCH SureTax - Batch Record Type | View |

| CCH SureTax - Exemption Code | View |

| CCH SureTax - Regulatory Code | View |

| CCH SureTax - Sales Type Code | View |

| CCH SureTax - Tax Included Code | View |

| CCH SureTax - Tax Object Setup | View |

| CCH SureTax - Tax Situs Rule | View |

| CCH SureTax - Tax Types | View |

| CCH SureTax - Transaction Type | View |

| CCH SureTax - Tax Option | Edit |

| CCH SureTax - Unit Type Code | View |

| CCH SureTax - Basic Configuration | Edit |

| CCH SureTax - Call Log | Edit |

| CCH SureTax - Call Log Update | Edit |

| CCH SureTax - Country | View |

| CCH SureTax - Exemption Reason | View |

Lists

| List | Permission Level |

|---|---|

| Customers | View |

| Subsidiaries | View |

| Locations | View |

| Items | View |

| Tax Items | View |

| Tax Details Tab | Edit |

- If the customer wants the role to execute our batch process or tax object setup, they will need the following permissions:

Setup

| Setup | Permission Level |

|---|---|

| SuiteScript Scheduling | Full |

| SuiteScript | View |

| Custom Lists | View |

Tax Registration for Subsidiary

- Go to Setup Company Subsidiary.

- In the subsidiary Add a line with country, nexus and tax agency.

- Ensure state-level Nexuses are end-dated and deactivated to support multiple shipping routes

Configuring CCH SureTax for NetSuite SuiteTax

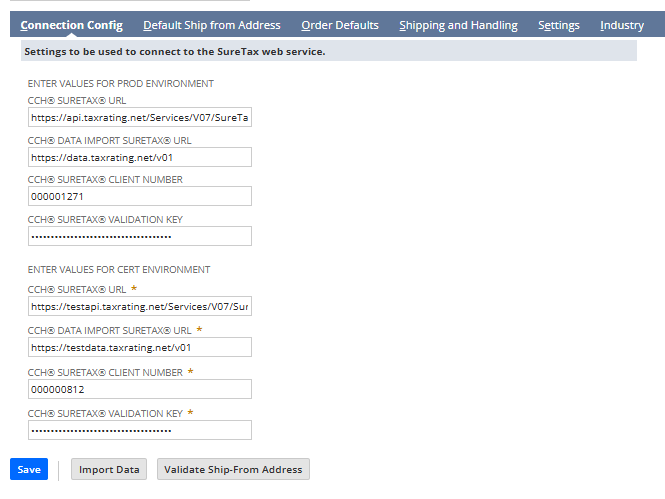

On the CCH® SureTax® Configuration form, you can set the connection information to CCH® SureTax®, default CCH® SureTax® tax calculation values, and more. To get to the form, go to CCH® SureTax® -> Configuration -> Basic Configuration. You can set the connection information for CERT and PROD seperately on the CCH® SureTax® Configuration form.

Here are some caveats around the configuration form screenshot above:

- If you don't have the CCH® SureAddress® plug-in installed, you won't see the "Validate Ship- From Address" button.

- If you don't have a NetSuite OneWorld account, you won't see the "Subsidiary" or "Enable CCH® SureTax® Plugin" field as it isn't applicable.

- You have to configure the parent (top level) subsidiary in order for data import to work. Even if you're not intending to use our plug in for that subsidiary.

This next section only applies if you have a NetSuite OneWorld account.

The CCH® SureTax® Configuration settings are stored differently for each subsidiary in your account. Changing the "Subsidiary" field at the top of the form will switch you to the settings for the selected sub- sidiary.

If you want the CCH® SureTax® plug-in to be used in a specific subsidiary, please check "Enable CCH® SureTax® Plugin" for the subsidiaries configuration form, and click save. If you don't want the CCH® SureTax® plug-in to be used for the subsidiary, leave "Enable CCH® SureTax® Plugin" field unchecked.

Importing Data

After installation, there aren't any values in the SureTax field records (e.g. transaction type code, sales type code). This fields need to be imported from SureTax. To import the data needed by the plug-in:

- Go to CCH SureTax > Configuration > Basic Configuration.

- Select a subsidiary if you have a NetSuite OneWorld account.

- Enter the information on the Connection Config, Data Import Connection Config, and Default Ship from Address tabs.

- Click Save. An alert displays reading "Save completed successfully." If it does not, double check that you entered the URLs and validation keys correctly

- Click Import Data. A new window displays the Map/Reduce Script Status page. Eleven jobs will be created. Wait until all of their statuses are Complete. Now all the data the plug-in needs from CCHSureTax is imported.

Configuration Form Fields

This section explains what each of the fields on the configuration form does.

| Tab | Field Name | Field Type | Description |

|---|---|---|---|

| Connection Config | CCH® SureTax® URL | Text | This should be the tax calculation URL given to you by CCH. Make sure if you are in a sandbox NetSuite account not to point this to production SureTax, but to the CERT environment. |

| Connection Config | CCH® SureTax® Client Number | Text | This is the client number that was given to you by CCH. This is used to place the transactions the plug-in makes into the correct SureTax account. |

| Connection Config | CCH® SureTax® Validation Key | Password | This is the validation key that was given to you by CCH. This is used as the password for each call to SureTax. |

| Data Import Connection Config | CCH® SureTax® URL | Text | This is the data API URL. This is used to get data from SureTax and place it into NetSuite. |

| Data Import Connection Config | CCH® SureTax® Client Number | Text | This is the client number that will be used to access the data API. |

| Data Import Connection Config | CCH® SureTax® Validation Key | Password | This is the validation key (password) that will be used to access the data API. |

| Default Ship from Address | Address1 | Text | This field is used as the street address for the Default Ship From Address. This address is sent to SureTax as the ship from address on sales transactions if the location (warehouse) is blank and the company/subsidiary shipping address is blank. |

| Default Ship from Address | Address 2 | Text | This field is used as the street 2 address for the Default Ship From Address. This address is sent to SureTax as the ship from address on sales transactions if the location (warehouse) is blank and the company/subsidiary shipping address is blank. |

| Default Ship from Address | City | Text | This field is used as the city for the Default Ship From Address. This address is sent to SureTax as the ship from address on sales transactions if the location (warehouse) is blank and the company/subsidiary shipping address is blank. |

| Default Ship from Address | State | Text | This field is used as the state for the Default Ship From Address. This address is sent to SureTax as the ship from address on sales transactions if the location (warehouse) is blank and the company/subsidiary shipping address is blank. |

| Default Ship from Address | Zip | Text | This field is used as the zip for the Default Ship From Address. This address is sent to SureTax as the ship from address on sales transactions if the location (warehouse) is blank and the company/subsidiary shipping address is blank. |

| Default Ship from Address | Country | Text | This field is used as the country for the Default Ship From Address. This address is sent to SureTax as the ship from address on sales transactions if the location (warehouse) is blank and the company/subsidiary shipping address is blank. |

| Order Defaults | Enable CCH® SureTax® Calculation | Checkbox | This field is defaulted on to the "Enable CCH® SureTax®" field on the transaction lines. Please see the "CCH® SureTax® Field Defaulting" section for more information on how this is done. |

| Order Defaults | Sales Type Code | Select | This field is defaulted on to the "Sales Type Code" field on the transaction lines. Please see the "CCH® SureTax® Field Defaulting" section for more information on how this is done. |

| Order Defaults | Regulatory Code | Select | This field is defaulted on to the "Regulatory Code" field on the transaction lines. Please see the "CCH® SureTax® Field Defaulting" section for more information on how this is done. |

| Order Defaults | Tax Exemption Code | Select | This field is defaulted on to the "Tax Exemption Code" field on the transaction lines. Please see the "CCH® SureTax® Field Defaulting" section for more information on how this is done. |

| Order Defaults | Unit Type Code | Select | This field is defaulted on to the Unit Type Code" field on the transaction lines. Please see the "CCH® SureTax® Field Defaulting" section for more information on how this is done. |

| Order Defaults | Tax Included Code | Select | This field is defaulted on to the "Tax Included Code" field on the transaction lines. Please see the "CCH® SureTax® Field Defaulting" section for more information on how this is done. |

| Order Defaults | Tax Situs Rule | Select | This field is defaulted on to the "Tax Situs Rule" field on the transaction lines. Please see the "CCH® SureTax® Field Defaulting" section for more information on how this is done. |

| Order Defaults | Transaction Type Code | Select | This field is defaulted on to the "Transaction Type Code" field on the transaction lines. Please see the "CCH® SureTax® Field Defaulting" section for more information on how this is done. |

| Order Defaults | Tax Exemption Reason | Select | This field is defaulted on to the "Tax Exemption Reason" field on the transaction lines. Please see the "CCH® SureTax® Field Defaulting" section for more information on how this is done. |

| Order Defaults | Tax Option | Select | This field is defaulted on to the "Tax Option" field on the Purchase transaction lines. Please see the "CCH® SureTax® Field Defaulting" section for more information on how this is done. |

| Shipping and Handling | Enable CCH® SureTax® Calculation | Select | This field is defaulted on to the "S&H Enable CCH® SureTax®" field on the transaction shipping tab. Please see the "CCH® SureTax® Field Defaulting" section for more information on how this is done. |

| Shipping and Handling | Sales Type Code | Select | This field is defaulted on to the "S&H Sales Type Code" field on the transaction shipping tab. Please see the "CCH® SureTax® Field Defaulting" section for more information on how this is done. |

| Shipping and Handling | Regulatory Code | Select | This field is defaulted on to the "S&H Regulatory Code" field on the transaction shipping tab. Please see the "CCH® SureTax® Field Defaulting" section for more information on how this is done. |

| Shipping and Handling | Tax Exemption Code | Select | This field is defaulted on to the "S&H Tax Exemption Code" field on the transaction shipping tab. Please see the "CCH® SureTax® Field Defaulting" section for more information on how this is done. |

| Shipping and Handling | Unit Type Code | Select | This field is defaulted on to the "S&H Unit Type Code" field on the transaction shipping tab. Please see the "CCH® SureTax® Field Defaulting" section for more information on how this is done. |

| Shipping and Handling | Tax Included Code | Select | This field is defaulted on to the "S&H Tax Included Code" field on the transaction shipping tab. Please see the "CCH® SureTax® Field Defaulting" section for more information on how this is done. |

| Shipping and Handling | Tax Situs Rule | Select | This field is defaulted on to the "S&H Tax Situs Rule" field on the transaction shipping tab. Please see the "CCH® SureTax® Field Defaulting" section for more information on how this is done. |

| Shipping and Handling | Shipping Transaction Type Code | Select | This field is defaulted on to the "Shipping Transaction Type Code" field on the transaction shipping tab. Please see the "CCH® SureTax® Field Defaulting" section for more information on how this is done. |

| Shipping and Handling | Handling Transaction Type Code | Select | This field is defaulted on to the "Handling Transaction Type Code" field on the transaction shipping tab. Please see the "CCH® SureTax® Field Defaulting" section for more information on how this is done. |

| Shipping and Handling | TaxExemption Reason | Select | This field is defaulted on to the "S&H TaxExemption Reason" field on the transaction shipping tab. Please see the "CCH® SureTax® Field Defaulting" section for more information on how this is done. |

| Settings | Send Stock Keeping Unit Not Transaction Type | Checkbox | If this field is checked, the plug-in will send the internal id of the item / expense / shipping method as the SKU toSureTax. If it is unchecked it will send the transaction type code that is set on the transaction line or the S&H Shipping Transaction Type Code field for shipping line to SureTax. |

| Settings | Enable Multicurrency | Checkbox | If you have the NetSuite feature "Multiple Currencies" enabled, check this. Otherwise uncheck it. |

| Industry | General | Checkbox | Check this if your company is not involved in the telecommunications or utilities industry. If only this is checked certain fields that pertain to the telecommunications and utilities industry is hidden. |

| Industry | Telecom | Checkbox | Check this if your company is involved in the telecommunications industry. If this is checked, certain fields will be shown that pertain to the telecommunications industry. |

| Industry | Utility | Checkbox | Check this if your company is involved in the utilities industry. If this is checked, certain fields will be shown that pertain to the utilities industry. |

Setting up Tax Objects

Before the plug-in can be used to calculate tax, the plug-in needs to generate tax codes, tax

types, and nexuses. To generate the tax codes, tax types, nexuses, and setup the tax registration, follow these

steps:

Go to CCH SureTax > Configuration > Tax Object Setup.

Select all of the countries/state combinations that you will be using the plug-in for.

Set the Receivable Account and Payable Account columns for all rows you selected. The Receivable Account and Payable Accounts have to be two different ledger accounts. You can set the two accounts at the header level, and click the "Default Receivable Account" or "Default Payable Account" button to set the header level value on all of the lines.

Set custom defaults for custom tax code for all rows you selected. You can set the Custom Tax code, Custom Tax Code Description, Suretax Tax Type at the header level, and click the "Default Custom Object" button to set the header level value on all of the lines.

Set the Create Custom Tax Object option under custom default to Yes to create the custom tax code. If it is set to No or Blank then custom taxcode won't be created.

If you want custom tax code for any country or state they should populate the Tax code,Tax code Description and Suretax Tax type fields otherwise can keep them blank.

Note: When creating tax objects please note that the process will fail, if the tax object is created with required fields.

Click Create Objects. The Map/Reduce Script Status page displays. Wait until the "CCH.SureTax.MapReduce.CreateTaxObjects" job's status is "Complete." If you have a NetSuite OneWorld account, there will be a subsidiary field at the top of the page. When you click Create Objects, the job will only create tax codes the selected subsidiary. If you plan to use the CCH SureTax plug-in with multiple subsidiaries, repeat the above steps for each subsidiary. Verify that all of the tax codes and tax types are created successfully. Refer to the tax code mapping section in the user guide for more information on what should be created.

Note: When creating tax objects please note that the process will fail, if the tax object is created with required fields. Tax object creation will fail if there are duplicate nexus and tax registration.

AP tax object with post to item cost set as true are created for US with default tax objects. For Canada, custom tax codes needs to be generated to create AP tax codes.

E.g: On the Tax Object Setup page, select a subsidiary. Under Custom Defaults tab, set create custom tax objects field to Yes. Check Canada/Manitoba state checkbox and set any receivable account and Payable account, type RST in the Tax code and tax code desc fields and U8 in the suretax Tax type field. Click Create Objects.

Setting up Custom Tax Codes

By default, the CCH SureTax plug-in creates a set of NetSuite Tax Types/Tax Codes and maps them to the CCH SureTax Tax Types. Then when you calculate tax on a transaction, the plug-in looks up the CCH SureTax tax type returned from CCH SureTax and sets the tax amount to the corresponding NetSuite Tax Type/Tax Code. The plug-in gives the user the ability to create a new NetSuite Tax Type/Tax Code and map it to a CCH SureTax tax type.

If the tax type is blank, that means it is the default tax type for this country, state, and subsidiary combination. This means that if the tax type returned from CCH SureTax doesn't have a mapping, then the tax amount is placed on this tax type/tax code.

To add a new tax code, do the following:

Installing and Configuring CCH SureTax

- Go to CCH SureTax > Configuration > Custom Tax Code.

- Select the country.

- Select the state.

- Select the subsidiary (if this is a OneWorld account).

- Scroll to the bottom of the grid, and on the new line check/uncheck the tax include checkbox, enter the tax code, tax code description, tax type, tax type description, SureTax tax type, receivable account, and the payable account.

- Click Add.

- Click Save. The new mapping is created.

- To delete any custom tax code, select the tax code line and click Remove.

- Click Save.

- Updating an existing mapping - delete the existing tax code and add a new one and save.

- Updating an existing mapping that was created by create tax objects (default pluggin mapping) - update the suretax tax type field and click save.

- If a default tax code mapping is updated and user tries to create tax object, the updated mapping will be overwritten.

Note: To verify the new tax code mapping, refer to the tax code mapping section for more information.

Data Exchange

The following parameters in the SureTax API can be filled in using the data exchange setup:

- Cost Center

- GL Account

- Material Group

- Parameter 1

- Parameter 2

- Parameter 3

- Parameter 4

- Parameter 5

- Parameter 6

- Parameter 7

- Parameter 8

- Parameter 9

- Parameter 10

They can be set to send different fields for different transaction forms, and then different line types (item, expense, shipping, and handling). So what ever field is set on the Field Name column, the field value on the transaction will be sent to SureTax in the associated parameter (parameter column).

To make these configurations for the sales transactions, go to CCH SureTax -> Configuration -> Data Exchange Setup - Sales. To make these configurations for the purchase transactions, go to CCH SureTax -> Configuration -> Data Exchange Setup - Purchase.

These configurations also only apply to the selected Subsidiary. Make sure to setup all necessary sub- sidiaries.

Header Fields

On each Sales transaction form, the CCH SureTax for SuiteTax plug-in adds the following fields on the Shipping Tab:

- S&H Enable CCH SureTax

- S&H Regulatory Code

- S&H Sales Type Code

- S&H Tax Exemption Code

- S&H Tax Included Code

- S&H Shipping Transaction Type Code

- S&H Handling Transaction Type Code (hidden if handling isn't charged separately from shipping)

- S&H Tax Situs Rule

- S&H Unit Type

- S&H Tax Exemption Reason

The values of these header fields are filled in on the page load, if they aren't already filled in. They are also filled in when the transaction is saved, barring that they aren't already filled in.

Here is where the values for the fields come from:

| Field Name | Defaulting Behavior |

|---|---|

| S&H EnableCCHSureTax | CCH SureTax Configuration > Shipping and Handling tab > Enable CCH SureTax Calculation |

| S&H Regulatory Code | CCH SureTax Configuration > Shipping and Handling tab > Regulatory Code |

| S&H SalesTypeCode | CCH SureTax Configuration > Shipping and Handling tab > Sales Type Code |

| S&H Tax Exemption Code | CCH SureTax Configuration > Shipping and Handling tab > Tax Exemption Code |

| S&H Tax Included Code | CCH SureTax Configuration > Shipping and Handling tab > Tax Included Code |

| S&H Shipping Transaction Type Code | CCH SureTax Configuration > Shipping and Handling tab > Shipping Transaction Type Code |

| S&H Handling Transaction Type Code | CCH SureTax Configuration > Shipping and Handling tab > Handling Transaction Type Code |

| S&H Tax Situs Rule | CCH SureTax Configuration > Shipping and Handling tab > Tax Situs Rule |

| S&H Unit Type | CCH SureTax Configuration > Shipping and Handling tab > Unit Type Code |

| S&H Tax Exemption Reason | CCH SureTax Configuration > Shipping and Handling tab > Tax Exemption Reason |

Line Fields

On each transaction form, the CCH SureTax for SuiteTax plug-in adds the following columns to the item/- expense lines:

- Enable CCH SureTax (disabled if plug-in is disabled for the subsidiary)

- Regulatory Code (disabled if plug-in is disabled for the subsidiary)

- Sales Type Code (disabled if plug-in is disabled for the subsidiary)

- Tax Exemption Code (disabled if plug-in is disabled for the subsidiary)

- Tax Included Code (disabled if plug-in is disabled for the subsidiary)

- Transaction Type Code (disabled if plug-in is disabled for the subsidiary)

- Tax option (for purchase transactions), (disabled if plug-in is disabled for the subsidiary)

- Tax Situs Rule (disabled if plug-in is disabled for the subsidiary)

- Unit Type (disabled if plug-in is disabled for the subsidiary)

- Billing Zip Code

- Billing Zip Code Extension

- Secondary Zip Code

- Secondary Zip Code

- Tax Exemption Reason (disabled if plug-in is disabled for the subsidiary)

The values of those columns are filled in when a line is added to the transaction, or on save of the transaction, if they hadn't already been filled in. Defaulting on save is to cover the scenario when the trans- action is not created from the UI.

Here is where the values for the line columns come from:

| Field Name | Defaulting Behavior |

|---|---|

| Enable CCH SureTax | Customer > CCH SureTax tab > Enable CCH SureTax Calculation otherwise CCH SureTax Configuration > Order Defaults > Enable CCH SureTax Calculation |

| Regulatory Code | Item > CCH SureTax Tab > Regulatory Code otherwise CCH SureTax Configuration > Order Defaults > Regulatory Code |

| Sales Type Code | Customer > CCH SureTax tab > SalesType Code otherwise CCH SureTax Configuration > Order Defaults > Sales Type Code |

| Tax Exemption Code | Customer > CCH SureTax tab > Exemption Code otherwise CCH SureTax Configuration > Order Defaults > Tax Exemption Code |

| Tax Exemption Reason | Customer > CCH SureTax tab > Exemption Reason otherwise CCH SureTax Configuration > Order Defaults > Tax Exemption Reason |

| Tax Option | Vendor > CCH SureTax tab > Tax Option otherwise CCH SureTax Configuration > Order Defaults > Tax Option |

| Tax Included Code | If line type is item: Item > CCH SureTax Tab > Tax Included Code, If line type is expense: Expense Category > Tax Included Code otherwise CCH SureTax Configuration > Order Defaults > Tax Included Code |

| Transaction Type Code | If line type is item: Item > CCH SureTax Tab > Transaction Type Code, If line type is expense: Expense Category > Transaction Type Code otherwise CCH SureTax Configuration > Order Defaults > Transaction Type Code |

| Tax Situs Rule | If line type is item: Item > CCH SureTax Tab > Tax Situs Rule, If line type is expense: Expense Category > Tax Situs Rule otherwise CCH SureTax Configuration > Order Defaults > Tax Situs Rule |

| Unit Type | If line type is item: Item > CCH SureTax Tab > Unit Type Code, If line type is expense: Expense Category > Unit Type Code otherwise CCH SureTax Configuration > Order Defaults > Unit Type Code |

| Billing Zip Code | None |

| Billing Zip Code Extension | None |

| Secondary Zip Code | None |

| Secondary Zip Code Extension | None |

Entity Fields

The CCH SureTax for SuiteTax plug-in adds the following fields to the NetSuite customers and vendors:

- Enable CCH SureTax Calculation

- Sales Type Code

- Exemption Code

- Exemption Reason

- Tax Option (Vendor only)

The values that are set on the customer/vendor will flow to every new line on transactions for them. I.e. If the Exemption Code is set to "All Taxes Exempt", then "All Taxes Exempt" will be set on each line's "Exemption Code" field.

If the "Enable CCH SureTax Calculation" field is left blank, then the value of "Enable CCH SureTax Calculation" on the basic configuration will be the one that is set on each line. If this value is "Yes", then "Enable CCH SureTax" on the line will always be checked on the lines, regardless of what the value is on the basic configuration. If this value is "No", then "Enable CCH SureTax" on the line will always be unchecked on the lines, regardless of what the value is on the basic configuration.

CCH SureTax Customer Exemptions

The CCH SureTax Customer Exemptions tab is available on customer forms, allowing users to add, edit, or delete tax exemptions from predefined lists. Once exemptions are saved, they are automatically submitted to the SureTax portal. To create a new exemption, click the "New" button under the CCH SureTax Customer Exemptions tab. This opens the ** CCH SureTax® Exemptions** window, where you can enter all necessary details and save the form.

Note: In the SureTax portal, the Customer Internal ID is displayed instead of the customer name.

Item/Expense Category Fields

The CCH SureTax for SuiteTax plug-in adds the following fields to the NetSuite items and expense categories:

- Tax Included Code

- Transaction Type Code

- Regulatory Code

- The following will only show if the "Telecom" or "Utilities" industry is checked in the basic configuration:

- Unit Type

- Tax Situs Rule

The values that are set on the item or expense category, flow onto the related line level fields when the item or expense category is selected on a transaction line.

Using SureTax for SuiteTax

Calculating Basic Tax

Tax calculation can be triggered via "Preview Tax" or "Save" button on the supported transaction forms. As items and shipping details are entered on transaction forms, SureTax settings for these items and ship- ping lines are defaulted based on Defaulting logic described in the "Defaults" section. These settings are used in conjunction with different addresses, Expenses/items and shipping charges to form SureTax Tax Calculation request to send to SureTax Web Service configured under CCH® SureTax® Configuration page. All line items including shipping and handling are sent to SureTax in a single request. Once request is received by SureTax it calculates tax and sends response back to NetSuite.

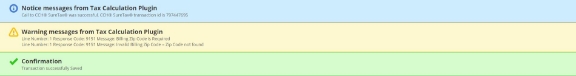

Response is processed by tax engine to pick NetSuite Tax Types and NetSuite Tax Codes based on SureTax Tax Type returned by SureTax. There is a mapping between SureTax Tax Types (e.g 01, 02, 03, 04, 05 etc) and NetSuite Tax Code (STUSCASSUB1 or STUSCAS etc). These mappings are created dur- ing Tax Object Setup process or via Custom Tax code creation process. With Successful tax calculation, Tax Details tab will display break down of taxes and rate information based on jurisdiction. Each line level break down of taxes are available by clicking the "SureTax Details" button.

Screen shot of Tax Details tab

In case of invalid SureTax Settings on Transaction (e.g Wrong Zipcode, location on transaction is Invalid), warnings are displayed on message bar on transaction forms. In such warning scenario SureTax Engine will send response with warning and $0 Tax. $0 will be mapped to place holder tax code based on trans- action settings. CCH® SureTax® can be used further to look at request and response by clicking on latest transaction link and going to request and response boxes.

Warning message

Using SureTax for SuiteTax • 15

CCH® SureTax® Tab and click Edit on Latest transaction to see request and response.

This section defines the relationship and value for each field between the plug-in and CCH SureTax For Accounts Receivable Forms

- Field name. The name of each field used in the plug-in.

- NetSuite Form. The path to the form in which that particular field can be found.

- Value. Explains what that field is.

| Field Name | NetSuite Form | Value |

|---|---|---|

| Customer Identifier | Quotes/Sales Order/Invoice/Cash Sales/Credit Memo/Return Authorization/Cash Refund/Opportunity | Internal ID |

| Client Number | Quotes/Sales Order/Invoice/Cash Sales /Credit Memo/Return Authorization/Cash Refund/Opportunity | ClientNumber |

| Business Unit | Quotes/Sales Order/Invoice/Cash Sales /Credit Memo/Return Authorization/Cash Refund/Opportunity | Business Unit |

| Validation Key | Quotes/Sales Order/Invoice/Cash Sales /Credit Memo/Return Authorization/Cash Refund/Opportunity | ValidationKey |

| Total Revenue | Quotes/Sales Order/Invoice/Cash Sales/Credit Memo/ReturnAuthorization/Cash Refund/Opportunity | TotalRevenue |

| ReturnFileCode | Quotes/SalesOrder/Invoice/Cash Sales /CreditMemo/Return Authorization/CashRefund/Opportunity | ReturnFileCode |

| ResponseGroup | Quotes/SalesOrder/Invoice/Cash Sales /CreditMemo/Return Authorization/CashRefund/Opportunity | ResponseGroup |

| ResponseType | Quotes/SalesOrder/Invoice/Cash Sales /CreditMemo/Return Authorization/CashRefund/Opportunity | ResponseType |

| ClientItems | Quotes/SalesOrder/Invoice/Cash Sales /CreditMemo/Return Authorization/CashRefund/Opportunity | ItemList |

| LineNumber | Quotes/SalesOrder/Invoice/Cash Sales /CreditMemo/Return Authorization/CashRefund/Opportunity | LineNumber |

| InvoiceNumber | Quotes/SalesOrder/Invoice/Cash Sales /CreditMemo/Return Authorization/CashRefund/Opportunity | InvoiceNumber |

| CustomerNumber | Quotes/SalesOrder/Invoice/Cash Sales /CreditMemo/Return Authorization/CashRefund/Opportunity | CustomerNumber |

| Origination Number | Quotes/SalesOrder/Invoice/Cash Sales/CreditMemo/Return Authorization/CashRefund/Opportunity | OrigNumber |

| Termination Number | Quotes/SalesOrder/Invoice/Cash Sales /CreditMemo/Return Authorization/CashRefund/Opportunity | TermNumber |

| BilledtoNumber | Quotes/SalesOrder/Invoice/Cash Sales /CreditMemo/Return Authorization/CashRefund/Opportunity | BillToNumber |

| BillingZipCode | Quotes/SalesOrder/Invoice/Cash Sales /CreditMemo/Return Authorization/CashRefund/Opportunity | Zipcode |

| BillingZipcode extension | Quotes/SalesOrder/Invoice/Cash Sales /CreditMemo/Return Authorization/CashRefund/Opportunity | Plus4 |

| BillingAddress | Quotes/SalesOrder/Invoice/Cash Sales/CreditMemo/Return Authorization/CashRefund/Opportunity | Transaction form billing address/Customer Default billing address |

| ShipToAddress | Quotes/SalesOder/Invoice/Cash Sales/CreditMemo/Return Authorization/CashRefund/Opportunity | Transaction form shipping address/Customer Default shipping address |

| ShipFrom Address | Quotes/SalesOrder/Invoice/Cash Sales/CreditMemo/Return Authorization/CashRefund/Opportunity | Line level warehouse location address/ Header level warehouse location address/Default ship from address |

| SecondaryZip code | Quotes/SalesOrder/Invoice/Cash Sales /CreditMemo/Return Authorization/Opportunity | P2PZipcode |

| SecondaryZip code extension | Quotes/SalesOrder/Invoice/Cash Sales /CreditMemo/Return Authorization/CashRefund/Opportunity | P2PPlus4 |

| Date of Transaction | Quotes/SalesOrder/Invoice/Cash Sales /CreditMemo/Return Authorization/CashRefund/Opportunity | TransDate |

| Revenue | Quotes/SalesOrder/Invoice/Cash Sales/Credit Memo/Return Authorization/Cash Refund/Opportunity | Revenue |

| Quotes/Sales | Order/Invoice/Cash Sales Units /Credit Memo/Return Authorization/Cash Refund/Opportunity | Units |

| Unit Type | Quotes/Sales Order/Invoice/Cash Sales /Credit Memo/Return Authorization/Cash Refund/Opportunity | UnitType |

| Quotes/Sales | Order/Invoice/Cash Sales Call Duration /Credit Memo/Return Authorization/Cash Refund/Opportunity | Seconds |

| Tax Included Code | Quotes/Sales Order/Invoice/Cash Sales /Credit Memo/Return Authorization/Cash Refund/Opportunity | TaxIncludedCode |

| Quotes/Sales | Order/Invoice/Cash Sales Tax Situs Rule /Credit Memo/Return Authorization/Cash Refund/Opportunity | TaxSitusRule |

| Transaction Type Code | Quotes/Sales Order/Invoice/Cash Sales /Credit Memo/Return Authorization/Cash Refund/Opportunity | TransTypeCode |

| Quotes/Sales | Order/Invoice/Cash Sales SalesTypeCode /Credit Memo/Return Authorization/Cash Refund/Opportunity | SalesTypeCode |

| Regulatory Code | Quotes/Sales Order/Invoice/Cash Sales /Credit Memo/Return Authorization/Cash Refund/Opportunity | Regulatory Code |

| Tax Exemption Codes | Quotes/Sales Order/Invoice/Cash Sales /Credit Memo/Return Authorization/Cash Refund/Opportunity | TaxExemptionCodeList |

| Tax Exemption Reason | Quotes/Sales Order/Invoice/Cash Sales/Credit Memo/Return Authorization/Cash Refund/Opportunity | ExemptReasonCode |

This section defines the relationship and value for each field between the plug-in and CCH SureTax For Accounts Payables Forms

- Field name. The name of each field used in the plug-in.

- NetSuite Form. The path to the form in which that particular field can be found.

- Value. Explains what that field is.

| Field Name | NetSuite Form | Value |

|---|---|---|

| Customer Identifier | Purchase Order / Bill / Bill Credit / Vendor Return Authorization | Internal ID |

| Client Number | Purchase Order / Bill / Bill Credit / Vendor Return Authorization | ClientNumber |

| Business Unit | Purchase Order / Bill / Bill Credit / Vendor Return Authorization | Business Unit |

| Validation Key | Purchase Order / Bill / Bill Credit / Vendor Return Authorization | ValidationKey |

| Total Revenue | Purchase Order / Bill / Bill Credit / Vendor Return Authorization | TotalRevenue |

| Return File Code | Purchase Order / Bill / Bill Credit / Vendor Return Authorization | ReturnFileCode |

| Response Group | Purchase Order / Bill / Bill Credit / Vendor Return Authorization | ResponseGroup |

| Response Type | Purchase Order / Bill / Bill Credit / Vendor Return Authorization | ResponseType |

| Client Items | Purchase Order / Bill / Bill Credit / Vendor Return Authorization | ItemList |

| Line Number | Purchase Order / Bill / Bill Credit / Vendor Return Authorization | LineNumber |

| Invoice Number | Purchase Order / Bill / Bill Credit / Vendor Return Authorization | InvoiceNumber |

| Customer Number | Purchase Order / Bill / Bill Credit / Vendor Return Authorization | CustomerNumber |

| Origination Number | Purchase Order / Bill / Bill Credit / Vendor Return Authorization | OrigNumber |

| Termination Number | Purchase Order / Bill / Bill Credit / Vendor Return Authorization | TermNumber |

| Billed to Number | Purchase Order / Bill / Bill Credit / Vendor Return Authorization | BillToNumber |

| Billing ZipCode | Purchase Order / Bill / Bill Credit / Vendor Return Authorization | Zipcode |

| Billing Zipcode extension | Purchase Order / Bill / Bill Credit / Vendor Return Authorization | Plus4 |

| Billing Address | Purchase Order / Bill / Bill Credit / Vendor Return Authorization | Transaction form billing address / Customer Default billing address |

| Ship To Address | Purchase Order / Bill / Bill Credit / Vendor Return Authorization | Transaction form shipping address / Customer Default shipping address |

| Ship From Address | Purchase Order / Bill / Bill Credit / Vendor Return Authorization | Line level warehouse location address / Header level warehouse location address / Defaultshipfromaddress |

| Secondary Zipcode | Purchase Order / Bill / Bill Credit / Vendor Return Authorization | P2PZipcode |

| Secondary Zipcode extension | Purchase Order / Bill / Bill Credit / Vendor Return Authorization | P2PPlus4 |

| Date of Transaction | Purchase Order / Bill / Bill Credit / Vendor Return Authorization | TransDate |

| Revenue | Purchase Order / Bill / Bill Credit / Vendor Return Authorization | Revenue |

| Units | Purchase Order / Bill / Bill Credit / Vendor Return Authorization Purchase Order / Bill / Bill Credit / Vendor Return Authorization | Units |

| UnitType | Purchase Order / Bill / Bill Credit / Vendor Return Authorization | UnitType |

| CallDuration | Purchase Order / Bill / Bill Credit / Vendor Return Authorization | Seconds |

| Tax Included Code | Purchase Order / Bill / Bill Credit / Vendor Return Authorization | TaxIncludedCode |

| Tax Situs Rule | Purchase Order / Bill / Bill Credit / Vendor Return Authorization | TaxSitusRule |

| Transaction Type Code | Purchase Order / Bill / Bill Credit / Vendor Return Authorization | TransTypeCode |

| Sales Type Code | Purchase Order / Bill / Bill Credit / Vendor Return Authorization | SalesTypeCode |

| Regulatory Code | Purchase Order / Bill / Bill Credit / Vendor Return Authorization | Regulatory Code |

| Tax Exemption Codes | Purchase Order / Bill / Bill Credit / Vendor Return Authorization | TaxExemptionCodeList |

| Tax Exemption Reason | Purchase Order / Bill / Bill Credit / Vendor Return Authorization | ExemptReasonCode |

| Tax Option | Purchase Order / Bill / Bill Credit / Vendor Return Authorization | TaxOption |

Enable SureTax Settings

Enable SureTax Settings on Line level allow Plug in to pick line and send to SureTax in tax calc request. If it is unchecked for a line, the line is ignored and will not be consider for tax calculation purpose. If trans- action contains only one line and Enable SureTax Settings is unchecked. Transaction will display fol- lowing warning message. Appropriate tax codes are used to write 0 tax on tax details tab.

Previewing Tax

Preview Tax button on supported transaction forms will calculate tax for entered expense and/or item lines, shipping and handling details however it will not save Tax information and transaction. By clicking "Tax Details" tab on form, one can view tax information for that transaction.

Preview tax button sends Quote request to SureTax Server. So this will not affect liability report in SureTax.

Preview Tax Cost

Since this button is making Quote calls to CCH SureTax, there is cost involved with this tax calculation. It is recommended to click save button on transaction form to avoid incurring additional quote call charges unless it is required for user to see taxes before transaction is saved.

CCH SureTax Details

The SureTax details button is visible once a transaction form is saved. The CCH® SureTax® Tax Details page contains detail information about the tax calculated for transactions.

- It includes SureTax Transaction Id, Invoice Number, Client Number, Customer Number used on transaction and Tax Amount on header. (Move to a table with a column for description)

- It also lists line details for each line sent to SureTax with "Enable CCH SureTax Calculation" checked. It shows the SureTax Settings, different addresses associated with each line, amount and date of transaction. Select a line and click "Tax Details" tab to display break down of taxes for that particular line. This will display Authority Name, SureTax Tax Type, Tax Type Description, Tax Amount, Taxable Amount, Tax Rate, Percentage taxable, and tax Category information. (Move to a table with a column for description)

- Data exchange fields

SureTax Details Header Fields

| Field Name | Description |

|---|---|

| CCH® SURETAX® TRANSACTIONID | Transaction Id sent by SureTax in response |

| INVOICE NUMBER | Invoice Number generated By NetSuite |

| CUSTOMER NUMBER | Internal ID of NetSuite Customer/Vendor |

| CCH® SURETAX® CLIENT NUMBER | ClientNumber |

| CCH® SURETAX® RETURN FILECODE | Plugin Sends Q for non-posting transactionand 0 for posting transactions |

| TAXAMOUNT | Tax Computed by SureTax |

Line Information In CCH SureTax Details

| Field Name | Description |

|---|---|

| Line Number | Line Number From NetSuite |

| Quantity | Quantity of the item |

| Amount | Amount |

| Item Message | Item Message response from SureTax |

| Transaction Date | Date of transaction |

| Tax Included Code | Tax Included code 0 or 1 based on Line setting |

| Tax Situs Rule | Tax Situs rule Line setting |

| Transaction Type Code | Transaction Type Code Line Setting |

| Sales Type Code | Sales Type Code Line setting |

| Regulatory Code | Regulatory Code Line Setting |

| Tax Exemption Codes | Tax Exemption Codeline setting |

| Freight On Board Code | FOB code line settings |

| Common Carrier | CommonCarrier Line setting |

| Unit Type | UnitType |

| Ship To Address | Transaction form shipping address/Customer Default shipping address |

| Ship From Address | Line level warehouse location address/Header level warehouse location address/Default ship from address |

| Billing Address | Transaction form billing address/Customer Default billing address |

| P2P Address | P2P address Setting based on P2P situs rule |

Tax Details for a line can be seen by selecting a line on line information Tab and clicking Tax Details Tab.

| Field Name | Description |

|---|---|

| Authority Name | Authority Imposing tax |

| Tax Type | Tax Type(e.g State level, county or City) |

| Tax Type Description | Description of Tax Type |

| Tax Amount | Tax Amount for current line for a Authority |

| Fee Amount | Fee Amount for current line for |

| Taxable Amount | Taxable amount for a current line |

| Tax rate | Tax rate |

| Percent taxable | Percent taxable of tax rate (If exempt it could be reduced or 0%) |

| Tax On Tax | Tax imposed on tax |

| Tax Category | Tax Category (e.g General sales or Telecom) |

| Tax Category Description | Tax Category Description |

| Tax Exemption Reason | Tax Exemption Reasonline setting |

Data Exchange Parameters

These are additional field that can be configured and send it to CCH SureTax for processing as per busi- ness need. To learn more about Data exchange, refer to Data Exchange topic in help file.

| Field Name | SureTax Request mapping |

|---|---|

| Cost Center | CostCenter |

| Material group | MaterialGroup |

| GLaccount | GLAccount |

| Parameter 1 | Parameter1 |

| Parameter 2 | Parameter2 |

| Parameter 3 | Parameter3 |

| Parameter 4 | Parameter4 |

| Parameter 5 | Parameter5 |

| Parameter 6 | Parameter6 |

| Parameter 7 | Parameter7 |

| Parameter 8 | Parameter8 |

| Parameter 9 | Parameter9 |

| Parameter 10 | Parameter10 |

Tax Code Mapping

Tax Code Mapping when the Subsidiary Feature is Enabled on NetSuite (One World Accounts)

All tax codes are automatically prefixed using a standardized format that includes:

- "ST" (a static prefix),

- followed by the country code and the state code.

Example: If the country is United States (US) and the state is California (CA), the tax code will be prefixed with "STUSCA". So, a tax code like TAX001 becomes STUSCATAX001. This format ensures consistency and helps identify the country and state associated with each tax code.

In addition to the standard prefixing of tax codes, we also append a suffix based on the subsidiary’s internal ID and specific tax settings.

For each tax code, the suffix SUB

For example, if the country is the United States (US), the state is California (CA), and the subsidiary has an internal ID of 1, the resulting tax codes would include suffixes such as SUB1N, SUB1Y, or SUB1AP depending on the configuration.

These suffixes help clearly identify the tax setup and subsidiary context for each tax code. Below are actual tax code create for California state with Subsidiary with internal Id 1 (assuming subsidiary telecom as industry). Following table illustrate mapping between tax code and SureTax Tax Type in Subsidiary enabled environment We prepend ST in conjunction with country code and state code for specific state codes For example Country is US and state is California, STUSCA is prepended to all taxcode for this state. For US California states following are the taxcode for assuming telecom is the industry SureTax call logs maintain SureTax request and response for a transaction. Call logs can be accessed by clicking edit on latest transaction under CCH SureTax tab. Request and response includes all settings and tax information which can be used for diagnosis or for analysis purpose. Discounts in NetSuite SuiteTax are always calculated before tax. For example a line with $100 item and line level 10% discount with tax is 8 percent will be taxed as below Total = (Amount - Discount Amount) + ((Amount - Discount Amount) * (TaxRate) ) (100 - 10) + ((100 - 10) * 0.08) = 97.2 Line level discounts are applied to line above the discount and computed amount will be used for tax cal- culation purpose. Example: Header level discount is applied to all lines, discount is computed on total amount of all lines and dis- counted amount is used to send to CCH SureTax for Tax Calculation. Example: The first line level discount is applied on items with discount and then header level discount is applied on top of it to send the line amount to CCH SureTax. Shipping and handling can be sent as a line in SureTax tax calculation request. The default settings for Shipping and handling are under CCH SureTax configuration page. To disable tax calculation on Ship- ping and handling charges uncheck "S&H Enable CCH SureTax" on Transaction page. If "CHARGE HANDLING SEPARATE FROM SHIPPING" is selected in Set up > Accounting > Shipping, then two separate lines for Shipping and handling lines are sent to CCH SureTax in the Tax Calculation request. Handling Transaction type code will be hidden if above check box is unchecked on shipping and handling tabs of Sales forms. The following transactions in NetSuite are posted to SureTax. Posted transactions in SureTax affects liab- ility reports for sales tax return. These transaction are updated with 0 status in Response Type column and Status Y when posted to SureTax. In NetSuite, when above transactions are saved they are posted to SureTax. If you open a saved transaction, edit it and save it again, the previous posted transaction to SureTax will be cancelled with Status C and new transaction is posted to SureTax with new details. The last posted transaction to SureTax is cancelled when the transaction is voided or deleted in NetSuite. CCH provides Sales and use tax option at line level, users can configure this settings on transaction before we send this to Suretax for Calculation. if we have mixed set of lines with Sales tax option and few with Use Tax option In case of Posting Purchase transaction, to show correct tax under SureTax Details button we need to make two calls first call being Quote call to SureTax to get tax information and Second call for posting use tax only. This is due to reason Sales tax on Purchase transactions are not posted to SureTax. Returns use original invoice date for tax calculation purpose for following transactions Return transactions are posted to CCH SureTax with negative amount to update sales tax return liability correctly. Multiple tax exemption codes can be specified for each line on a transaction. All exemption codes spe- cified will then be sent to SureTax in the tax calculation request. To select multiple exemption codes: With SureTax for SuiteCommerce Standard or Advanced, you can quickly and accurately calculate sales tax on sales orders submitted using the web store checkout. To do this you must have the SureTax for SuiteTax Sales for NetSuite plug-in installed. SureTax will calculate tax each time the website triggers a tax calculation. The tax amount will be returned to SuiteCommerce and a confirmation email including the tax and total order. Furthermore, all orders created on the website will be sent to SureTax as queries so they will not impact the tax liability until they are transferred as a cash sale in NetSuite. Note: For sales orders created on the SuiteCommerce website, SureTax can exempt customers based on exemptions assigned to them in the SureTax Console as well as in NetSuite. The SureTax integration will recognize customer-specific and item-specific CCH Settings in NetSuite. Unlike sales orders created in NetSuite, SureTax will calculate tax on all SuiteCommerce website orders regard- less of whether the customer is a registered user or a guest. SureTax supports item-specific pro- motions on website orders and promotions that are applicable for all items.

United States

Tax Code

SureTax Tax Types

STUSCASSUB1AP

01,02,03,04,05

STUSCASSUB1N

01,02,03,04,05

STUSCASSUB1Y

01,02,03,04,05

STUSCAUSUB1N

U1,U2,U3,U4,U5

STUSCAUSUB1Y

U1,U2,U3,U4,U5

STUSCAFRAFSUB1N

60

STUSCAFRAFSUB1Y

60

STUSCAFUSFSUB1N

35

STUSCAFUSFSUB1Y

35

STUSCASLRSSUB1N

06,08,09,17,18,20,22,26,33

STUSCASLRSSUB1Y

06,08,09,17,18,20,22,26,33

STUSCATEXSUB1N

Default

STUSCATEXSUB1Y

Default

Canada

Tax Code

SureTax Tax Types

STCABCFRAFSUB1N

60

STCABCFRAFSUB1Y

60

STCABCFUSFSUB1N

35

STCABCFUSFSUB1Y

35

STCABCGPHSUB1N

Default

STCABCGPHSUB1Y

Default

STCABCGSTSUB1N

40

STCABCGSTSUB1Y

40

STCABCPSTSUB1N

42

STCABCPSTSUB1Y

42

STUSCASLRSSUB1N

06,08,09,17,18,20,22,26,33

STUSCASLRSSUB1Y

06,08,09,17,18,20,22,26,33

STCABCUSUB1N

U6,U7,U8

STCABCUSUB1Y

U6,U7,U8

VAT Countries

Tax Code

SureTax Tax Types

STAUTEXSUB3N

Default

STAUTEXSUB3Y

Default

STAUVATSUB3N

51

STAUVATSUB3Y

51

Tax Code Mapping when the Subsidiary Feature is Not Enabled

United States

Tax Code

SureTax Tax Types

STUSCASAP

01,02,03,04,05

STUSCASN

01,02,03,04,05

STUSCASY

01,02,03,04,05

STUSCAUN

U1,U2,U3,U4,U5

STUSCAUY

U1,U2,U3,U4,U5

STUSCAFRAFN

60

STUSCAFRAFY

60

STUSCAFUSFN

35

STUSCAFUSFY

35

STUSCASLRSN

06,08,09,17,18,20,22,26,33

STUSCASLRSY

06,08,09,17,18,20,22,26,33

STUSCATEXN

Default

STUSCATEXY

Default

Canada

Tax Code

SureTax Tax Types

STCABCFRAFN

60

STCABCFRAFY

60

STCABCFUSFN

35

STCABCFUSFY

35

STCABCGPHSN

Default

STCABCGPHY

Default

STCABCGSTN

40

STCABCGSTY

40

STCABCPSTN

42

STCABCPSTY

42

STUSCASLRSN

06,08,09,17,18,20,22,26,33

STUSCASLRSY

06,08,09,17,18,20,22,26,33

STCABCUN

U6,U7,U8

STCABCUY

U6,U7,U8

VAT Countries

Tax Code

SureTax Tax Types

STAUTEXN

Default

STAUTEXY

Default

STAUVATN

51

STAUVATY

51

SureTax Log

Calculating Discounts

Line Level Discount

Header Level Discount

Header and Line Level Discount on the Same Order

Shipping and Handling

Posting to CCH SureTax

Sales/Use Tax Options on Purchasing

Returns

Selecting Multiple Exemption Codes

Using SureTax for SuiteCommerce Standard or Advanced

How it Works

Known Issues